what is a covered tax lot

This section displays sales transactions of assets that were owned for one year or less. File a final Form 1099-B for the year the short sale is closed as described above but do not include the 2021 tax withheld on that Form 1099-B.

2130 Blankenship Dr Covered Back Patio House Styles Home

Covered Securities and Form 1099-B.

. A tax lot is a grouping of a security that has the same price and trade date. This is the first time I am doing my own taxes to save a little money. Proceeds 25 Cost blank.

This is a tax document that reports the sale of stocks bonds mutual funds and other investment securities. Note that selecting one of the Various options under Date Sold will. Explanation on side says Principal payment cost basis factor 0000145393.

Your capital gain or loss is equal to the difference between the assets cost basis and the sales price of the closing transaction. Long Term Transactions for Covered Tax Lots. The trust has high fees but I was not aware that they sell a bit of the fund each WEEK to pay for the fees as I got a section of my 1099-B for UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS.

A tax-lot relief method is used to determine which lots of a security are liquidated first in a given sales transaction. A tax lot is a record of the date quantity and cost of a purchase or opening transaction short sale. For noncovered shares the cost basis reporting is sent only to you.

Cost basis refers to the price including fees at which you purchased a security adjusted for corporate changes. Covered cost basis means that your brokerage firm is responsible for reporting cost basis and sale information to the IRS. Covered securities with long-term gain or loss.

For a noncovered security select Box 3 Cost Basis NOT Reported to the IRS. However the new regulations are not applicable to. Covered means basis is reported to the IRS.

Often you will see a title above your stock sales that would say Long-term with covered or Long-term with basis reported to the. Find out what covered and noncovered mean and how this designation will affect the way we report your cost basis to the IRS. Leave the other numbered boxes blank.

As lots are sold or short sell lots are covered the system will break up the lots if the amount of shares being sold or covered does not equal the existing lots they are matching to. Holding period is traced by tax lot and cost basis is generally tracked by tax lot. Capital GainLoss Sch D Select New and enter the description of the security.

As part of this responsibility your firm is required to send this information with your account when your. 1099-b has undetermined term transaction of 25 for non covered lot. The vast majority of my trades are.

The main difference relates to who is responsible for reporting cost basis information to the IRS when you sell investments. In most cases a trade represents a tax lot. In tax year 2011 new legislation was passed requiring brokers to report adjusted basis and whether any gain or loss on a sale is classified as short-term or long-term from the sale of covered securities on Form 1099-B.

The cost basis for these transactions is not reported to the IRS. For a covered security select Box 3 Cost Basis Reported to the IRS. This section displays sales transactions of assets that were owned for more than one year.

Brokers that use substitute statements may be able to report customer transactions. Stock splits would be one example. You are responsible for reporting the sale of noncovered shares.

F or tax-reporting purposes the difference between covered and noncovered shares is this. A check in box 6 of Form 1099-B indicates that the broker is reporting the cost basis to the. Generally a stock trade settles.

For tax-reporting purposes the difference between covered and noncovered shares is this. The assigned tax lots for the sale of a covered security cannot be changed once the trade settles. The tax lots are multiple purchases made on different dates at differing prices.

Brokers and mutual fund companies now track cost and holding periods for recently purchased shares. Covered securities defined later with short-term gain or loss. Noncovered securities securities that are not covered securities if you choose to check box 5 when reporting their sale.

So from what I understand the cost basis is not provided to the IRS and Vanguard will not do a clean long term or short term gainloss like. Every time you buy shares you create a new tax lot that records the number of shares the transaction date and the cost basis. I am looking through my 1099 MISC from my taxable brokerage account and wondering what short term transactions for NONCOVERED tax lots is supposed to represent.

Investment brokers are first tasked with citing whether an investment is a covered security on Form 1099-B. Sometimes you will see a box checked in the covereduncovered column. For covered shares were required to report cost basis to both you and the IRS.

Covered shares are generally ones you purchased after 2010. Noncovered means basis is not reported to the IRS. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares A tax lot identification method is the way we determine.

Each tax lot therefore will have a different cost basis. Short Term Transactions for Noncovered Tax Lots in 1099 Misc for Stock Trades. Prior to this time frame it was hit or miss to get this level of detail from investment firms.

03-15-2021 0412 PM. In box 1a enter a brief description of the transaction for example 5000 short sale of 100 shares of ABC stock not closed. The 1099-B specifies this in a couple of ways.

Fortunately tax straddle rules do not apply to qualified covered calls A qualified covered call is a covered call with more than 30 days to expiration at the time it is written and a strike price that is not deep in the money The definition of deep in the money varies by the stock price and by the time to expiration of the sold call. Covered noncovered shares. For covered shares were required to report cost basis to both you and the IRS.

Enter the remaining information as requested. In turn it helps identify the cost basis and holding period of the asset sold. Short Term Transactions for Non-covered Tax Lots.

Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security. Financial institutions are now required to report the adjusted cost basis of covered securities and debt securities to the IRS on Form 1099-B.

:max_bytes(150000):strip_icc()/GettyImages-914675658-ef28de13799f4a8582e3c46be4e1668a.jpg)

How To Use Tax Lots To Pay Less Tax

Estate Planning Checklist 2022 In 2022 Estate Planning Estate Planning Checklist Planning Checklist

Irs2go Apps On Google Play App Tax Help Google Play

Vat Penalties Call Backs Accounting Good Things

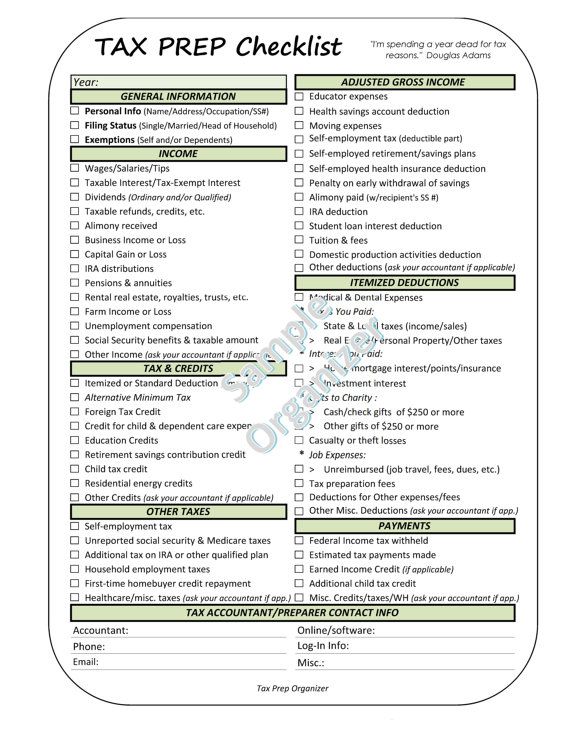

Collective Tax Prep Checklist Tax Prep Health Savings Account

Pin On Home Garden Infographics

Victorian Times Worksheet Free Esl Printable Worksheets Made By Teachers Time Worksheets World History Teaching World History Lessons

So You Re Moving To A New State Wrenne Financial Planning Lexington Ky Moving To Colorado Moving To Florida Moving Tips

Tu Bishvat Chocolate Covered Pretzel Trees Recipe Tu B Shevat Recipe For Kids Chocolate Covered Pretzels Chocolate Pretzels Food Activities

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Complete Guide To E Way Bill Registration Generation Activation Faq S Bills Activities Filing Taxes

Paradym Fusion Viewer New Homes Realty House

Problem Solving With Decimals A Trip To Bed Bath And Beyond Consumer Math Real Life Math Math Methods

Capital Gains Tax On Real Estate And Selling Your Home In 2021 Bankrate Capital Gains Tax Capital Gain Bankrate Com

Acknowledgment Receiptdate Is To Acknowledge That I Received The Total Amount Of Three M Receipt Lettering Sample Resume

Pin On N R Doshi And Partners Blog Post

A List Of Some Of The Taxes We Pay Federal Income Tax Indirect Tax Tax Services

The 1099 Decoded The What Who Why How 1099s Small Business Accounting Small Business Organization Small Business Success