tax break refund unemployment

You may qualify for the tax break up to 10200 of unemployment compensation if your modified adjusted gross income MAGI is less than 150000 for 2020. What you should do now.

Unemployment 10 200 Tax Break Some May Need To Amend Returns For Tax Refunds

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue Plan went into effect. Expect it in May. This is not the amount of the refund taxpayers will receive.

If valid bank account information is not available the IRS will mail a paper check to your address of record. Billion for tax year 2020. Premium federal filing is 100 free with no upgrades for premium taxes.

Since the IRS began issuing refunds for this it has adjusted the taxes of 117 million people sending out 144 billion overall. IRS sends out another 430000 refunds for 2020 unemployment benefit overpayments. When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

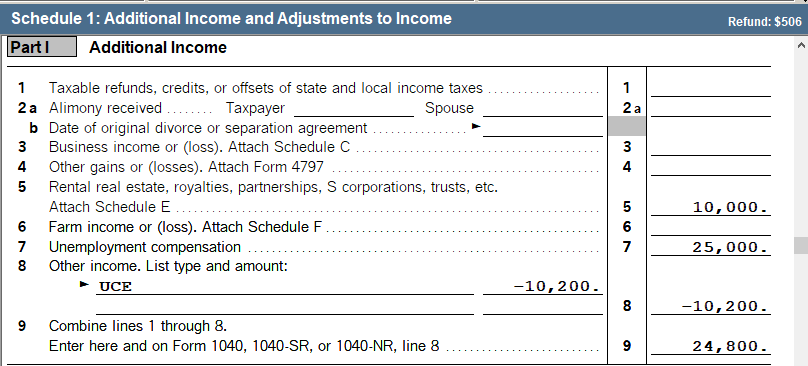

Unemployment refunds are scheduled to be processed in two separate waves. ARPA allows eligible taxpayers to exclude up to 10200 of unemployment compensation on their 2020 income tax return. Refund for unemployment tax break.

These will start going out in June and continue through the. 100 free federal filing for everyone. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation.

If youre entitled to a refund the IRS will directly deposit it into your bank account if you provided the necessary bank account information on your 2020 tax return. The first10200 in benefit income is free of federal income tax per legislation passed in March. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

IR-2021-159 July 28 2021. Ad File your unemployment tax return free. Getting a refund for your unemployment tax break.

For married taxpayers separate exclusions can apply to the unemployment compensation paid to each spouse. The second wave will recalculate taxes owed by taxpayers who are married and filing jointly as well as individuals with more complicated returns. This tax break was applicable.

This batch totaled 510 million with the average refund being 1189. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. The first wave will recalculate taxes owed by taxpayers who are eligible to exclude up to 10200.

Good news -- if you filed your 2020 taxes without claiming a tax break on your unemployment income the IRS will take care of it for you. If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. You had to qualify for the exclusion with a modified adjusted gross income of less than 150000.

HR Block is here to help. The IRS has identified 16. 24 and runs through April 18.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break. The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits. Unemployment Federal Tax Break.

The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144. That law waived taxes on up to 10200 in unemployment insurance benefits for individuals earning less than 150000 a year. The recently passed 19.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The federal tax code counts jobless benefits. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

All totaled officials say they have identified 16 million people who are eligible for the adjustment. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify. The recently-signed 19 trillion American Rescue Plan did a lot of.

Those set to receive a refund are taxpayers who took unemployment in 2020 but filed their taxes before the American. Congress hasnt passed a law offering. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

The 10200 is the amount of income exclusion for single filers not. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. Whether youre wondering how to claim the unemployment tax break if you already filed or are getting ready to do so Block has your back.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. In total over 117 million refunds have. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. This means if they have one coming to them than most who filed an individual tax return. If youre married each qualifying spouse may exclude up to 10200.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. When can I expect my unemployment refund. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits.

The IRS announced it will automatically issue refunds for the unemployment tax break. President Joe Biden signed the pandemic relief law in March. The IRS is starting to send money to people who fall in this categorywith more refunds slated to arrive this summer.

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. In the latest batch of refunds announced in November however the average was 1189.

You May Get an Automatic Refund. Tax season started Jan. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

Refunds For Unemployment Compensation. This means that you dont have to pay federal tax on the first 10200 of your unemployment benefits if your.

Irs Continues Unemployment Compensation Adjustments Prepares Another 1 5 Million Refunds The Southern Maryland Chronicle

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Unemployment 10 200 Tax Break Some May Need To Amend Returns For Tax Refunds

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Unemployment Tax Break Update Irs Issuing Refunds This Week Kare11 Com

Irs Announces It Will Automatically Correct Tax Returns For Unemployment Tax Breaks

Unemployment Tax Refund Update What Is Irs Treas 310 Wfaa Com

Nearly 10million People Who Paid Unemployment Taxes Are Getting 10 200 Refunds From Irs

Up To 10 Million Taxpayers Could Get An Additional Tax Refund For Unemployment

When Will Unemployment Tax Refunds Be Issued Whas11 Com

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

When Will Irs Send Unemployment Tax Refunds 11alive Com

Generating The Unemployment Compensation Exclusion In Proseries

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

When Will Irs Send Unemployment Tax Refunds 11alive Com

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return