child tax credit 2021 dates

We dont make judgments or prescribe specific policies. Within 8 weeks of our receiving your application online within 11 weeks of sending your application by mail Payments stopped or changed Go to If your payment stopped or changed.

Claim Your 30 Solar Investment Tax Credit Itc Solar Electric Contractor In Seattle Wa Solar Tax Credits Solar Energy Projects

2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

. By August 2 for the August payment August 30 for the. 6833 per year or 56941 per month for each child under the age of 6. Ad Access Tax Forms.

Heres the maximum that Canadian families can receive from the CCB as of November 2021. IR-2021-153 July 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. It provides information about the Child Tax Credit.

Households claiming tax credits will get the first half of a 650. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

HR6505 - Child Tax Credit for Pregnant Moms Act of 2022 117th Congress 2021-2022 Bill Hide Overview. Understand that the credit does not affect their federal benefits. That means another payment is coming in about a week on Oct.

Smith Jason R-MO-8 Introduced 01252022. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self.

Child tax credit payments will revert to 2000 this year for eligible taxpayers credit. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. But when will your first check.

Complete Edit or Print Tax Forms Instantly. Eligible taxpayers who dont want to receive advance payment of the 2021 child tax. Find out if they are eligible to receive the Child Tax Credit.

The IRS pre-paid half the total credit amount in monthly payments from. A MILLION households on tax credits are set to get a cash payment to help with the cost of living this week. If your payment is late check the payment date on your award notice and contact your bank before calling HMRC.

The first round of advance payments were sent to families of nearly 60 million. Local holidays in Scotland Your payment might be delayed because of. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Qualified individuals received monthly child tax credit payments from July through December 2021. As part of the American Rescue Act signed into law by President Joe Biden in. The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments.

Home of the Free Federal Tax Return. Visit ChildTaxCreditgov for details. See what makes us different.

CBS Philadelphia -- The first round of advance Child Tax Credit payments will be sent out on July 15. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. E-File Directly to the IRS.

Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April 20 2022 May 20. July 14 2021 752 PM CW69 Atlanta. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

2021 Child Tax Credit Advanced Payment Option Tas

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit Payments Will Start In July The New York Times

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

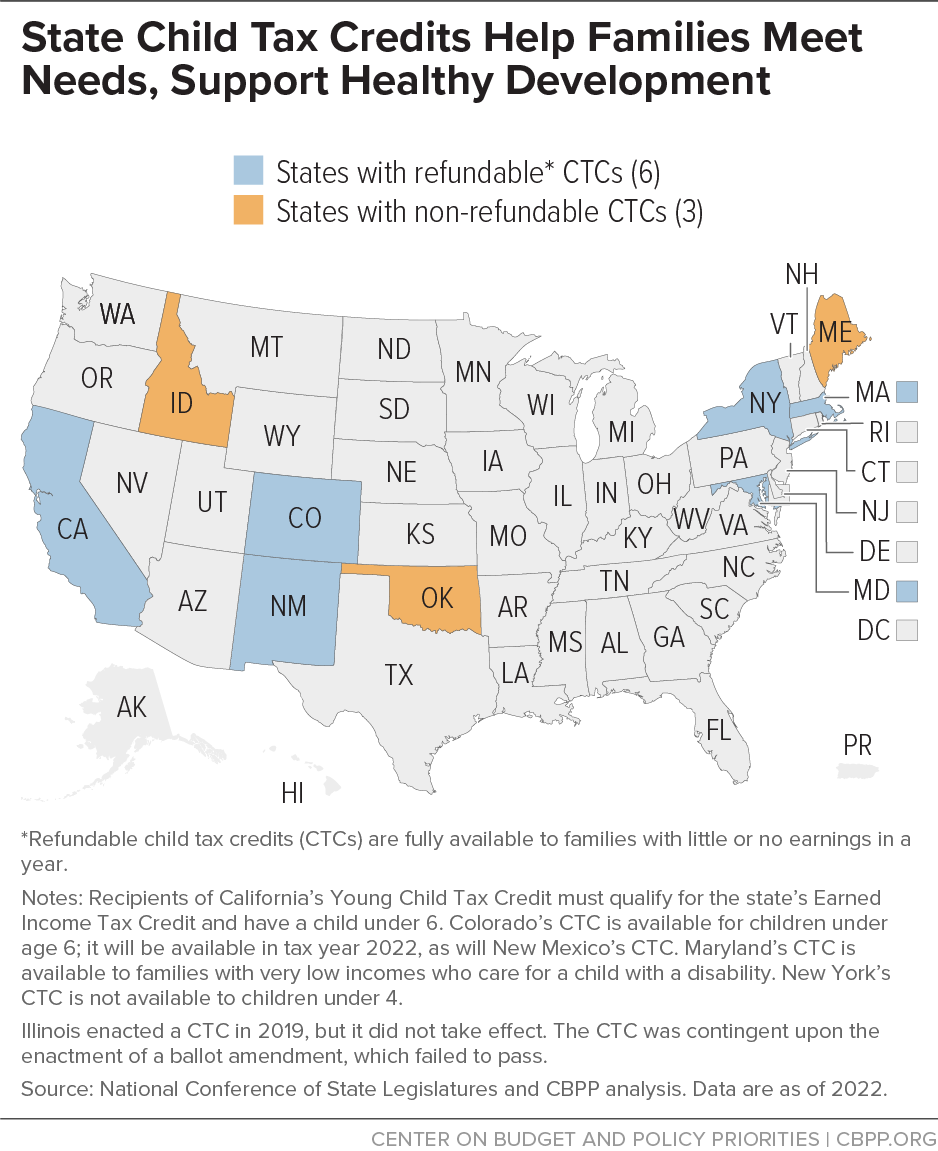

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Childctc The Child Tax Credit The White House

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet